In today’s digital age, scammers employ increasingly sophisticated methods to defraud people of their hard-earned money. With advancements in technology, the methods used by fraudsters evolve rapidly, making it essential for individuals to stay informed and vigilant. Sadly, we see people who are financially devastated by falling for scams. These are kind, smart people who have been conned out of their money and found themselves in a lot of debt from being defrauded.

This article delves into the top current scams, shedding light on their mechanics, the red flags to watch for, and how to protect yourself from falling victim.

1. Phishing Scams

Phishing remains one of the most prevalent forms of online scams, where fraudsters impersonate legitimate organizations via email, text messages, or social media to trick individuals into providing sensitive data. This data often includes personal information, banking details, and passwords.

How it works: Scammers craft convincing messages that appear to be from reputable entities, such as banks, government agencies, or familiar online platforms. These messages often contain urgent requests or threats, prompting the recipient to click on a malicious link or attachment, leading to the theft of personal information.

Red flags: Unsolicited messages that demand immediate action, contain spelling and grammar mistakes, and include suspicious links or attachments.

Protection: Always verify the source before clicking on links or providing personal information. Use multi-factor authentication on all accounts and regularly update passwords.

2. Investment Scams

Investment scams lure individuals with promises of high returns with little to no risk. These schemes often involve cryptocurrencies, precious metals, or revolutionary technologies.

How it works: Scammers present lucrative investment opportunities, often through unsolicited offers. They use high-pressure tactics to rush decisions, boasting guaranteed profits and exclusive access to insider information.

Red flags: Promises of high returns with minimal risk, pressure to invest quickly, and requests for payment in cryptocurrencies or via wire transfer.

Protection: Research any investment opportunity thoroughly before committing funds. Consult with a financial advisor and avoid making decisions based on unsolicited offers.

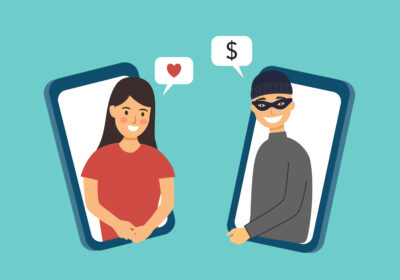

3. Romance Scams

Romance scams exploit individuals looking for romantic partners, typically via dating websites, apps, or social media. Scammers create fake profiles, establish relationships, and eventually trick victims into sending money.

How it works: After gaining trust, the scammer fabricates a crisis or a need for funds, often related to medical emergencies, travel expenses, or a business opportunity.

Red flags: Rapid escalation of the relationship, reluctance to meet in person or video call, and requests for money.

Protection: Be cautious with online relationships, especially if the person refuses to meet in person or via video calls. Never send money to someone you have not met in person.

4. Tech Support Scams

Tech support scams trick individuals into believing their computer has a security problem that can only be fixed by paying for technical support.

How it works: Scammers use pop-up messages, emails, or phone calls to warn victims of a supposed virus or hacking attempt on their computer, offering immediate tech support for a fee.

Red flags: Unsolicited messages claiming your computer is at risk, requests for remote access to your device, and demands for payment via gift cards or wire transfers.

Protection: Do not click on pop-up warnings or respond to unsolicited tech support messages. Always keep your computer’s software up to date and use reputable antivirus software.

5. Job Scams

Job scams prey on job seekers by offering fake job opportunities that require payment for training, certification, or supplies upfront.

How it works: Scammers post convincing job listings or reach out directly, often for remote positions, requiring the job seeker to pay for necessary training or equipment before starting.

Red flags: Job offers that seem too good to be true, requests for payment to secure the position, and lack of a thorough interview process.

Protection: Research the company thoroughly, be wary of offers without interviews, and never pay for the promise of employment.

6. Lottery and Sweepstakes Scams

These scams inform victims that they’ve won a lottery or sweepstakes they didn’t enter, but they must pay a fee or provide personal information to claim their prize.

How it works: Scammers contact individuals via mail, email, or phone, congratulating them on winning a large sum of money or a valuable prize. To claim the winnings, victims are instructed to pay taxes, fees, or provide bank account details.

Red flags: Winning a contest you did not enter, requests for payment to claim a prize, and demands for personal or financial information.

Protection: Remember, legitimate lotteries or sweepstakes do not require winners to pay fees upfront. Be skeptical of any such claims and verify their authenticity.

Conclusion

Scammers continually devise new methods to defraud individuals, exploiting human emotions such as fear, love, and greed. The best defense against these scams is education and vigilance. Always approach unsolicited offers and requests with skepticism, conduct thorough research before making any financial decisions and protect your personal information diligently. By staying informed about the latest scam tactics, you can safeguard yourself and your finances against these ever-evolving threats.

If you have fallen victim to scam and are struggling financially as result, don’t fell ashamed and scared to ask for help. We can help you evaluate your options to get your finances back on track.